Gold Price Forecast: XAU/USD bulls target $1,820 after the breakout – Confluence Detector

- Gold has broken above $1,800, this time in a more significant manner.

- The upbeat mood in markets and the breather in the rise of US yields is helping.

- Gold Price Forecast: XAU/USD eyes a firm break above $1795 amid growing inflation fears

Bitcoin has reached all-time highs, stocks have followed – is it time for gold to break higher? XAU/USD is, at least, moving above $1,800. Last week's upside move proved indecisive, but this latest surge is more substantial. The precious metal is already valued at $1,805.

How is XAU/USD positioned on the technical chart?

Gold Price: Key levels to watch

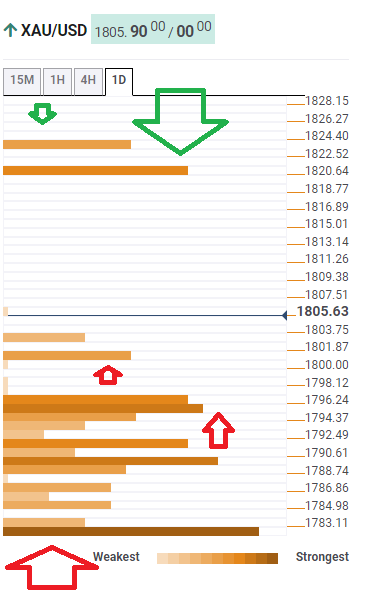

The Technical Confluences Detector is showing that the precious metal faces resistance at $1,820, which is where the Pivot Point one-month Resistance 1 hits the price.

It is followed by $1,823, which is where another pivot point awaits, the one-week Resistance 2.

Looking down, some support is at $1,801, where the previous week's top converges with the PP one-day Resistance 3.

Another cushion awaits at $1,795, which is the confluence of the Simple Moving Average 10-15m, the previous 4h-high and the PP one-week R1.

Much lower, a barrier against bearish attacks is at $1,783, which is where the Fibonacci 38.2% one-week and the BB 4h-Middle meet up.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.