Back

7 Jun 2021

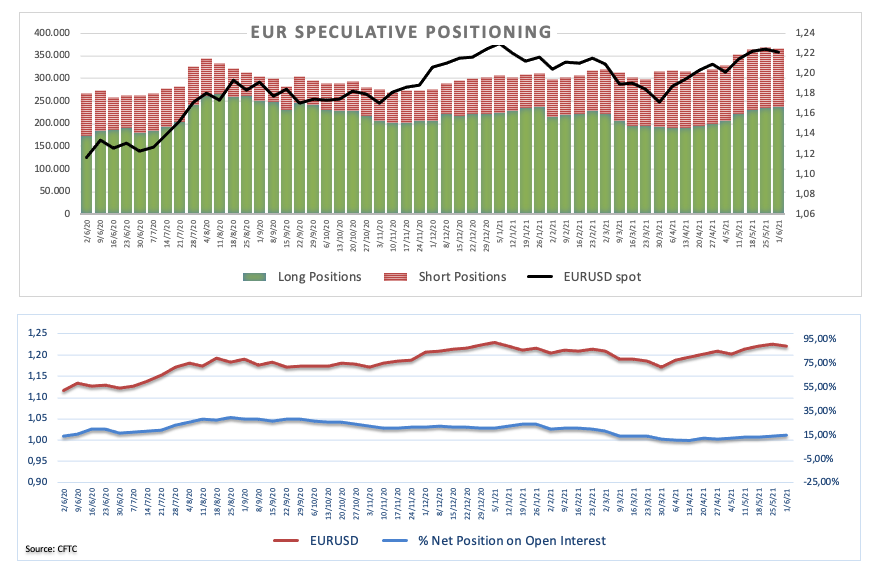

CFTC Positioning Report: EUR net longs at 3-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on June 1st:

- Specs added EUR gross longs for yet another week and pushed net longs to levels last seen in early March just below the 110K contracts. As usual in past weeks, the recovery in the Old Continent in combination with the firmer pace of the vaccination campaign and better results from domestic fundamentals continued to underpin the perseverant build-up of longs in the single currency.

- Net longs in USD rose for the third week in a row, taking the net positioning to multi-week highs. The consolidative mood in DXY plus a generalized side-lined theme in the markets prevailed amidst the Fed’s dovish narrative and steady US yields.

- GBP net longs eased to 4-week lows, as doubts seem to persist around the fully re-opening of the UK economy despite of the improvement in both morale and the docket.

- Net shorts in JPY retreated to 3-week lows, as market participants keep closely following the progress of the pandemic in Asia.