US Dollar Index bounces off lows near 90.70

- DXY starts the week on the defensive below the 91.00 mark.

- US 10-year yields manage to grab some traction and test 1.58%.

- Durable Goods Orders, Dallas Fed Index next on tap in the US docket.

The greenback, when tracked by the US Dollar Index (DXY), keeps the bearish note unchanged below the 91.00 yardstick at the beginning of another week.

US Dollar Index looks to risk trends, FOMC

The index adds to Friday’s pullback and navigates under a persistent downside pressure and still below the 91.00 level amidst a mild rebound in US yields and the upbeat tone in the risk universe.

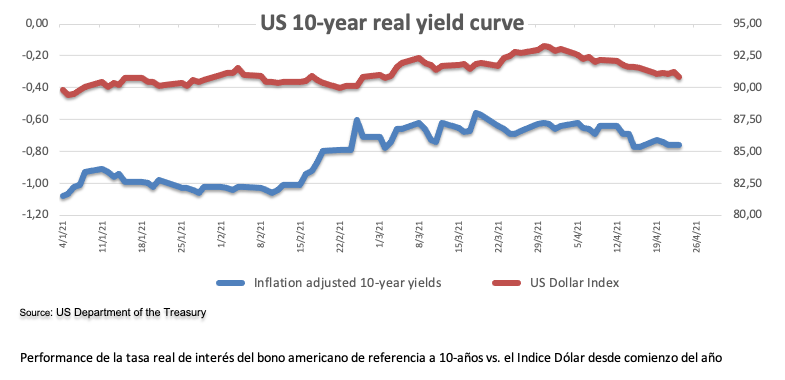

Indeed, yields of the key US 10-year reference manage to gather some mild upside traction following recent lows in the 1.53% zone, still far from monthly tops beyond 1.75% seen early in April.

In the meantime, investors continue to favour the risk-associated assets in detriment of the safe havens, always against the backdrop of rising optimism on the economic rebound outside the US, which has been underpinned further as of late by a firmer vaccine rollout.

In the US docket, the focus of attention will be in the release of Durable Goods Orders for the month of March seconded in relevance by the Dallas Fed manufacturing gauge and short-term notes auctions.

What to look for around USD

The April pullback in the dollar remains well and sound, always on the back of the broad-based retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the buck emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made), and rising optimism on a strong global economic recovery, all morphing into a solid source of support for the risk complex and a most likely driver of probable weakness in the dollar in the next months.

Key events in the US this week: Durable Goods Orders (Monday) – CB Consumer Confidence (Tuesday) – FOMC meeting (Wednesday) – Flash Q1 GDP, Initial Claims (Thursday) – Core PCE, Personal Income/Spending, final April U-Mich Index.

Eminent issues on the back boiler: Biden’s new infrastructure bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

At the moment, the index is losing 0.06% at 90.77 and faces the next support at 90.68 (monthly low Apr.26) ahead of 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6). On the other hand, a break above 91.66 (50-day SMA) would open the door to 92.06 (200-day SMA) and finally 93.43 (2021 high Mar.31).