Back

16 Mar 2021

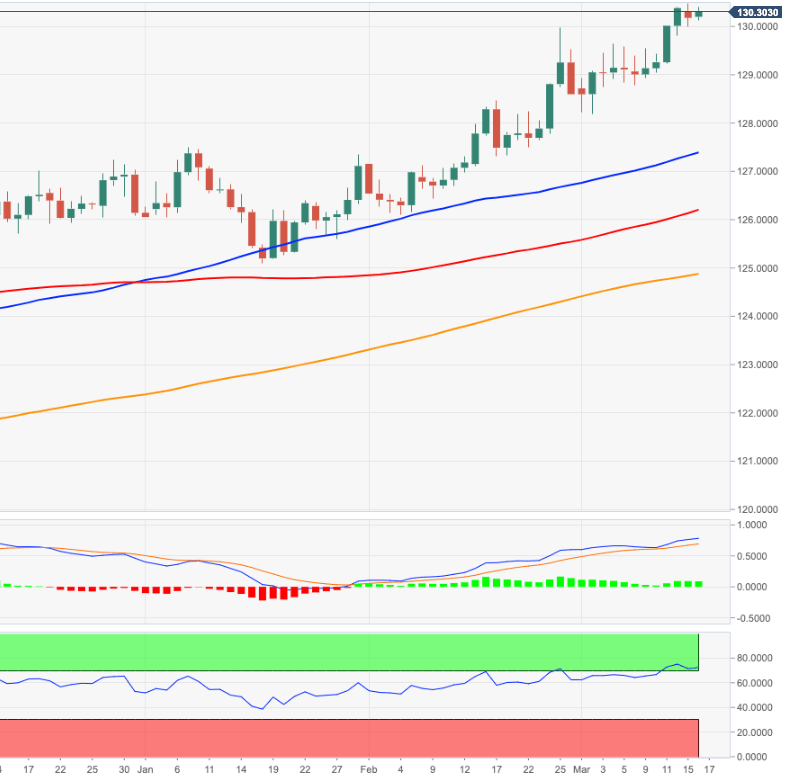

EUR/JPY Price Analysis: Consolidation likely near-term

- EUR/JP eases some ground from Monday’s YTD highs near 130.50.

- Correction not ruled out on the back of overbought levels.

EUR/JPY resumes the upside following the small downtick at the beginning of the week despite clinching new yearly peaks around 130.50.

The bid bias in the cross remains well and sound for the time being. That said, extra gains appear likely with the next interim target at the 131.00 hurdle followed by the summer 2018 high at 131.98 (July 17).

Reinforcing the current positive stance, EUR/JPY keeps trading above the immediate support line (off November 19 2020 low) in the 127.45 area, also coincident with the 50-day SMA.

In the meantime, while above the 200-day SMA at 124.81 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart