When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The British economic calendar is set to dominate the markets moves at 06:00 GMT with the first quarter (Q1) GDP figures for 2020. Also increasing the importance of that time are March month Trade Balance and Industrial Production details.

The United Kingdom GDP is expected to arrive at -8.0% MoM in March versus -0.1% prior while the Index of Services (3M/3M) for the same period is seen higher from 0.2% to 0.30%.

The first readout of the Q1 2020 GDP is seen weaker at -2.5% QoQ and -2.1% YoY versus 0.0% and +1.1% respective priors.

Meanwhile, the Manufacturing Production, which makes up around 80% of total industrial production, is expected to slump 6% MoM in March against +0.5% recorded in February. Further, the total Industrial Production is expected to come in at -5.6% MoM for March as compared to the previous reading of +0.1%.

Considering the yearly fact, the Industrial Production for March is expected to have dropped by 9.3% versus -2.8% previous while the Manufacturing Production is also anticipated to have declined by 10.4% in the reported month versus -3.9% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £10.00 billion versus an £11.487 billion deficit reported in February.

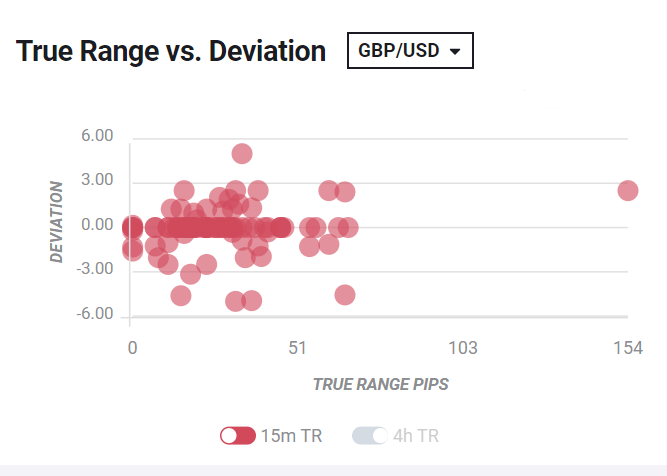

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD stalls its downside momentum established for the last two days while battling near the late-April low surrounding 1.2250, with all eyes on the critical UK macro releases.

Although traders are waiting for the key data near April low, a sustained break of an upward sloping trend line from April 06 keeps sellers hopeful of targeting April month low near 1.2165 beneath 1.2250. Meanwhile, a descending trend line from April 30, at 1.2400 now, keeps the pair’s recoveries capped whereas the support-turned-resistance line near 1.2285 can check immediate buying.

It should additionally be noted that while the data is likely to have a downside impact on the Cable pair, sellers might also take clues from Brexit and virus updates.

Key notes

UK GDP Preview: How calamitous was the initial coronavirus carnage? Three scenarios for GBP/USD

GBP/USD Price Analysis: Break of short-term support line probes three-week low under 1.2300

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.