Back

3 Oct 2019

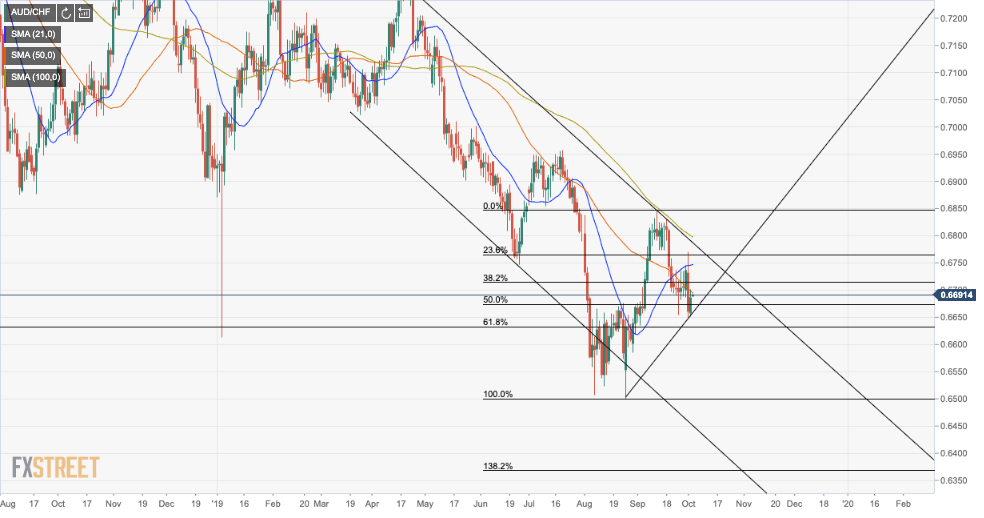

AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8% Fibo

- Bulls target risk back to the top of the channel and recent highs of 0.6750.

- Bears seek a break of trendline support and a resumption of the downside within the bearish channel.

AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs.

The Swiss Nation Bank has evidently been intervening in recent weeks, protecting its currency against strength vs the euro, although, on a technical basis, vs the Aussie dollar, the breach of the 50% Fibonacci level within a descending channel and below the 21-day moving average exposes risk of a run to the 61.8% target. Bears are in pursuit of a break of the trend-line support. On the other hand, should the bulls advance, a break of the 50-DMA will open the 21-DMA and risk back to the top of the channel and recent highs of 0.6750.

AUD/CHF daily chart