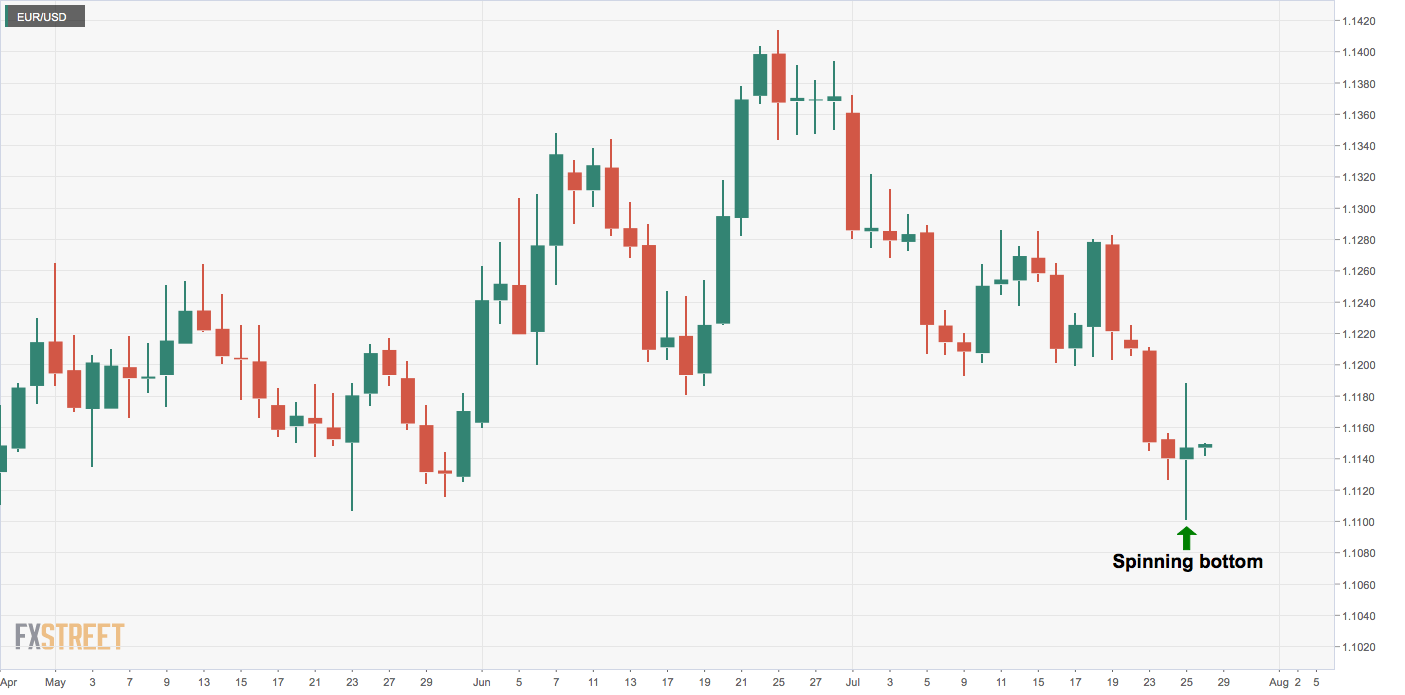

EUR/USD technical analysis: Spinning bottom makes today’s close pivotal

- EUR/USD charted a spinning bottom candle on Thursday.

- A close today above 1.1188 would confirm seller exhaustion.

EUR/USD witnessed two-way business before one Thursday and ended the day with moderate gains.

Essentially, the pair created a spinning bottom candle, which consist of short real body centered between long wicks.

The spinning bottom is widely considered a sign of indecision in the market place. In EUR’s case, however, the candlestick has appeared following a sell-off from 1.14 and at two-year lows.

So, it could be said that the indecision is predominantly among sellers. So, the EUR/USD pair may pick up a bid and rise to 1.12 today.

That said, a bullish reversal would be confirmed only if the pair closes today above 1.1188 (spinning bottom’s high). That would validate the seller exhaustion signaled by the candlestick pattern.

A close above 1.1188 could be seen as the daily chart moving average convergence divergence (MACD) histogram is reporting a bullish divergence.

On the downside, a close below 1.1103 (spinning bottom’s low) would signal a continuation of the sell-off from recent highs above. 1.14.

Daily chart

Trend: Bullish

Pivot points