Back

21 Jan 2019

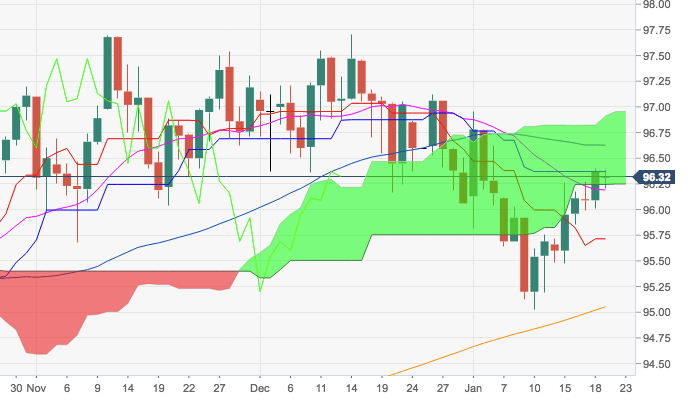

US Dollar Index Technical Analysis: Upside remains firm. Door open for a visit to 97.00

- DXY is extending the strong rebound from yearly lows in the 95.00 neighbourhood, managing to retake 96.00 the figure and pierce the base of the daily cloud.

- The continuation of the bull run appears likely in the near term, with the immediate target now at the 97.00 handle, or YTD peaks.

- The interim hurdle aligns at the 55-day SMA, today at 96.60, ahead of the 23.6% Fibo retracement of the September-December up move.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.33

Today Daily change: -0.04 pips

Today Daily change %: -0.04%

Today Daily Open: 96.37

Trends:

Daily SMA20: 96.18

Daily SMA50: 96.65

Daily SMA100: 96.07

Daily SMA200: 95.02

Levels:

Previous Daily High: 96.4

Previous Daily Low: 96.01

Previous Weekly High: 96.4

Previous Weekly Low: 95.47

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.25

Daily Fibonacci 61.8%: 96.16

Daily Pivot Point S1: 96.12

Daily Pivot Point S2: 95.87

Daily Pivot Point S3: 95.73

Daily Pivot Point R1: 96.51

Daily Pivot Point R2: 96.65

Daily Pivot Point R3: 96.9