USD/CAD clinches session tops near 1.3250

The Canadian Dollar continues to lose ground vs. its American neighbour on Tuesday, now lifting USD/CAD to fresh daily peaks in the mid-1.3200s.

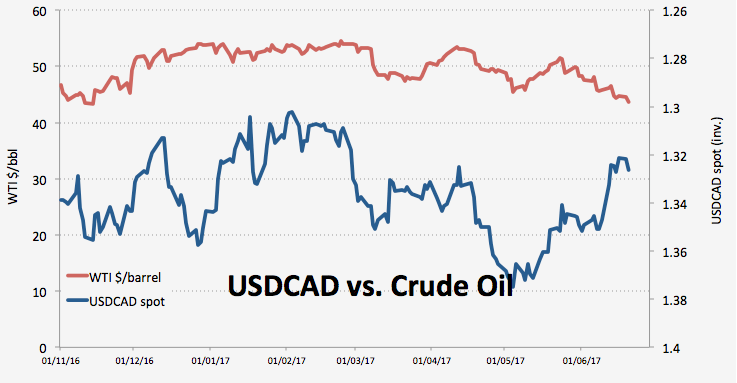

USD/CAD up as WTI plummets

CAD is gathering increasing selling pressure after the barrel of West Texas Intermediate is down around 2% to the area of $43.50, levels last seen in November 2016. WTI remains under pressure as recent sentiment among traders deteriorated further in response to rising concerns over the supply glut.

The pair is thus advancing for the second consecutive session, looking to extend the rebound from last week’s fresh 4-month lows near 1.3160 following the BoC’s shift to a more aggressive tone, as per recent speeches by Deputy Governor C.Wilkins and Governor S.Poloz.

Ahead in the week, Canadian inflation figures are expected on Friday, while the weekly report on US supplies by the API and the EIA are next on tap later today and tomorrow, respectively.

USD/CAD significant levels

As of writing the pair is gaining 0.33% at 1.3263 facing the next hurdle at 1.3310 (high Jun.15) followed by 1.3312 (23.12% Fibo of the May-June drop) and then 1.3340 (200-day sma). On the downside, a break below 1.3163 (low Jun.14) would open the door to 1.3007 (low Feb.16) and finally 1.2967 (2017 low Jan.31).